About Bankruptcy Attorney

Table of ContentsThe 25-Second Trick For Bankruptcy Lawyers Near MeThe Bankruptcy Australia DiariesThe Best Guide To Bankruptcy Court10 Simple Techniques For BankruptcyThe Bankruptcy Business DiariesHow Bankruptcy Business can Save You Time, Stress, and Money.

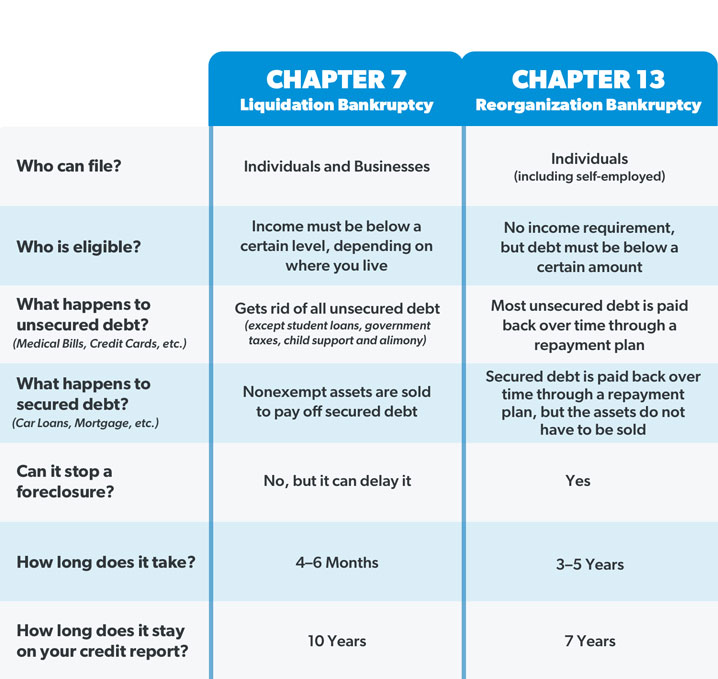

Chapter 13 is usually more effective to phase 7 since it makes it possible for the debtor to maintain a valuable possession, such as a house and allows the borrower to recommend a "strategy" to repay financial institutions over time typically 3-5 years. Chapter 13 is additionally used by consumer debtors who do not get phase 7 alleviation under the methods examination.Phase 13 is very different from chapter 7 considering that the phase 13 borrower typically stays in ownership of the residential property of the estate and also pays to creditors, through the trustee, based on the debtor's anticipated income over the life of the plan. Unlike phase 7, the borrower does not obtain an immediate discharge of debts.

This magazine reviews the applicability of Chapter 15 where a borrower or its home is subject to the legislations of the United States as well as one or more foreign nations.

Insolvency Law in the USA is Federal Legislation under Title 11 of the United States Code. In other words, New Jacket Insolvency Law is primarily assisted by the United States Code. You have actually most likely listened to of Chapter 7, or Chapter 11, or Chapter 13. Those are real phases "in guide" of the Bankruptcy Code, as well as each Phase affords special provisions.

The Buzz on Bankruptcy Australia

A Phase 7 personal bankruptcy is applicable to both companies and also individuals. In a business environment, a Chapter 7 personal bankruptcy is a liquidation. In the most basic terms, the properties of the company are sold to pay financial institutions pursuant to a priority system. In an individual Chapter 7 bankruptcy, there is no liquidation of the person.

Many individuals who file Personal bankruptcy are permitted to maintain every one of their present building and also can acquire credit scores in the future. There is no minimum amount of debt required in order to be qualified to submit for Personal bankruptcy. All financial obligation needs to be detailed on a Bankruptcy request. There are numerous additional inquiries which we can address for you throughout a consultation.

If you took a lending to acquire an automobile and can not make your month-to-month repayments, your car can be repossessed by the loan provider. A common period to be concerned concerning repossession would certainly be 45-75 days delinquency. There are several

The Best Strategy To Use For Bankruptcy Attorney

Youngster and also spousal support obligations and also just recently incurred revenue tax obligation bills are usual instances of "nondischargeable debt." And also the court will not discharge pupil financings unless you submit a separate legal action as well as meet the needs to winsomething many people can not do. Even if you have nondischargeable debt, personal bankruptcy may still be an alternative.

You'll utilize the very same exemptions in both Chapters 7 and also 13.

In Chapter 7, you would certainly shed the nonexempt residential property, and the trustee selected to handle your case would certainly sell bankruptcy back taxes it and offer the proceeds to your financial institutions. In Chapter 13, you do not lose nonexempt property. Instead, you have to pay lenders what it deserves via the repayment plan. Evaluation your state's insolvency exceptions to obtain a feeling for the home you would certainly maintain (state web links go to the base).

For the many part, companies don't submit for Phase 7 or 13. Instead, consider Phase 11 or Phase 11 subchapter V for little organizations.

Bankruptcy Business - Truths

Getting approved for Chapter 13 isn't ever easy, and due to the various complex guidelines, you'll intend to collaborate with a bankruptcy lawyer. Until reference after that, you can find out about the Phase 13 payment plan and get an idea about whether you make adequate revenue to cover what you'll need to pay.

It's not ideal, however it will show you what you must pay (you may have to pay more). Soon after you submit your "request" or personal bankruptcy documents, calls, letters, wage garnishments, and also collection lawsuits must come to a stop.

You'll pass on financial institution statements, income stubs, tax obligation returns, as well as various other documents for the personal useful reference bankruptcy trustee's review. All filers will certainly participate in a "341 meeting of lenders." At the conference, the trustee will inspect your recognition and ask inquiries about your filing. Lenders can show up and ask questions also, yet they rarely do.

Normally, after one year you will be released from personal bankruptcy as well as all of your financial obligations will be written off. Bankruptcy deals with both secured and unsafe financial debt.

The Only Guide for Bankruptcy Australia

In some circumstances, the High Court can make you bankrupt at the demand of a creditor. A lender can petition for personal bankruptcy against you if you have devoted an act of bankruptcy within the previous 3 months.

As soon as your insolvency begins, you are cost-free of debt. Your lenders can no much longer look for settlement directly from you.

Any individual can examine this register. Learn more in the ISI guide After you are made bankrupt (pdf). The Official Assignee will certainly negotiate an Income Settlement Arrangement or look for a Revenue Settlement Order for the excess of your revenue over the reasonable living expenses for your circumstance, based upon the ISI's guidelines.

Getting My Bankruptcy Benefits To Work

If you obtain properties after the day when you are made insolvent (as an example, with inheritance) the Authorities Assignee can assert them and also sell them for the benefit of your financial institutions. If you own a household residence, on your own or with an additional individual, the Authorities Assignee may only offer it with the prior consent of the court.

If you hold residential or commercial property jointly (for instance, with your partner) your personal bankruptcy will certainly create the joint possession to be divided in between the Authorities Assignee as well as your non-bankrupt co-owner. If the Official Assignee has not sold your home within 3 years, possession might instantly move back to you, unless otherwise concurred.